In the financial landscape of the United Kingdom, a credit score is a key indicator of your financial health. It’s a numeric representation used by credit agencies like Experian, Equifax, and TransUnion to determine your creditworthiness. Understanding what constitutes a bad credit score is essential for managing your financial life effectively.

What is creditworthiness?

Creditworthiness refers to an assessment of the likelihood that a borrower can repay a loan or meet financial obligations. It’s typically determined by lenders and credit rating agencies who examine factors such as the borrower’s credit score, financial history, current income, and existing debts.

A person deemed creditworthy is more likely to be approved for new credit and may receive more favourable borrowing terms, like lower interest rates or higher borrowing limits. This concept is crucial in financial contexts, influencing decisions on loans and other forms of credit.

Defining a Bad Credit Score

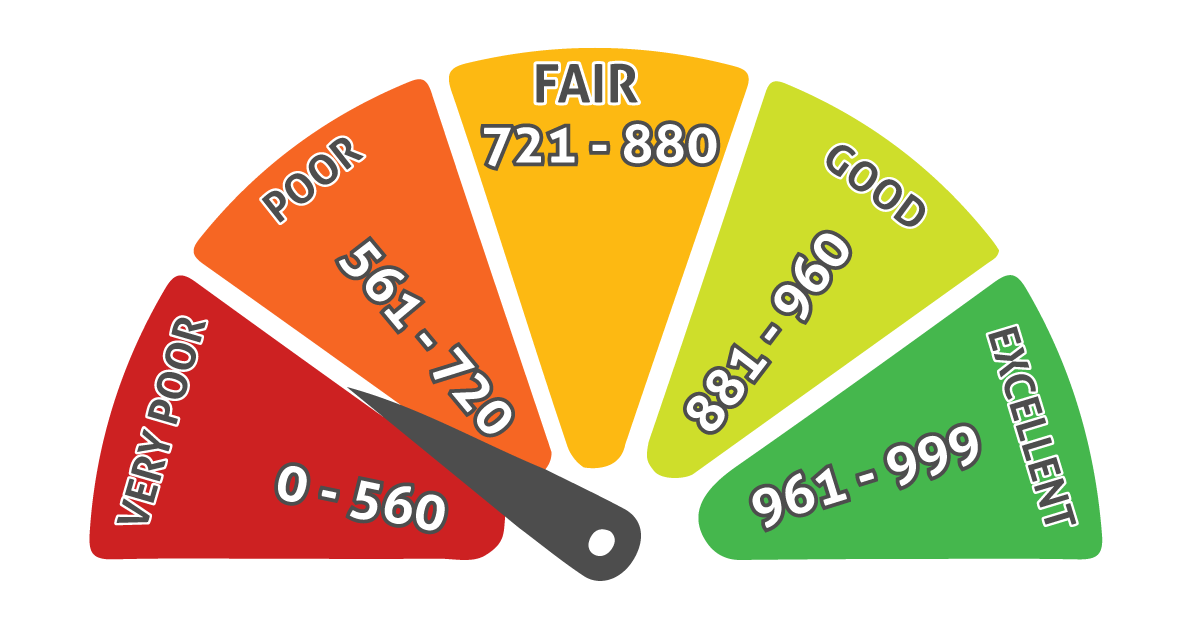

A bad credit score varies across different credit reporting agencies. Each agency has its own scale and criteria, but typically, a low score indicates higher risk to lenders and might result in less favourable credit terms.

Here’s what you need to know about each agency’s scoring system:

- Experian: Scores range from 0-999, with anything below 720 often considered poor.

- Equifax: Their scores go from 0-700, with scores under 380 categorised as poor.

- TransUnion: This agency’s scores range from 0-710, with scores below 566 deemed as poor.

Factors Leading to a Bad Credit Score

Several factors may contribute to a lower credit score:

1. Missed or Late Payments:

- Impact: Payment history is typically the most significant factor in your credit score. Late or missed payments could severely impact your score because they indicate a higher risk of default to lenders.

- Details: This includes all forms of credit obligations, such as credit card payments, car finance repayments, loan instalments, mortgage payments, and even some service bills like mobile phone contracts. A history of late payments can stay on your credit report for up to six years.

2. Length of Credit History:

- Impact: A shorter credit history provides less data for credit agencies to assess your financial behaviour. This may result in a lower credit score as there’s less evidence of long-term financial stability.

- Details: This factor considers the age of your oldest credit account, your newest account, and the average age of all your accounts. Keeping older accounts open could help lengthen your credit history.

3. Credit Searches:

- Impact: Frequently applying for new credit could lower your score, as it may suggest to lenders that you’re in financial distress or are taking on more credit than you can handle.

- Details: Each application typically involves a ‘hard search’, which could affect your score. These searches can remain on your report for up to two years. However, ‘soft searches’, such as checking your own score, do not impact your score.

4. Credit Mix:

- Impact: Having a mix of different types of credit (like a mortgage, car loan, and credit card) could positively impact your score, as it shows you can handle various types of credit responsibly.

- Details: This is a less significant factor than others, but managing different types of credit demonstrates to lenders your versatility in handling financial obligations.

Consequences of a Bad Credit Score

Having a bad credit score could affect you in several ways:

1. Higher Interest Rates on Loans and Credit Cards:

- Explanation: Lenders may view those with bad credit scores as higher risk, which often leads to higher interest rates on loans and credit cards. This means you’ll pay more over the life of any borrowed funds.

- Long-Term Impact: Over time, higher interest rates could lead to significantly increased costs, making it more challenging to pay off debt and potentially leading to a deeper cycle of debt.

2. Difficulty in Obtaining Credit:

- Explanation: Banks and other lenders are more hesitant to extend credit to individuals with poor credit scores. This could mean being denied for credit cards, personal loans, mortgages, or other forms of credit.

- Impact on Life Events: This may affect major life decisions, such as buying a home or a car, as these often require substantial loans that might not be available or come with prohibitive terms.

3. Problems Renting Homes or Apartments:

- Explanation: Many landlords conduct credit checks on potential tenants. A bad credit score may lead to rental applications being denied.

- Long-Term Implications: This could limit housing options and may require you to pay higher security deposits or find a co-signer for your lease.

4. Increased Insurance Premiums:

- Explanation: Some insurance companies use credit scores to determine premium rates. A lower score may lead to higher premiums for car, home, and even life insurance.

- Financial Impact: This could add additional monthly expenses, affecting your overall budget and financial planning.

5. Employment Challenges:

- Explanation: Certain jobs, especially in the finance sector or positions that require handling of money, could require a credit check. A poor credit score could sometimes hinder your job prospects.

- Career Implications: This could limit your employment opportunities or advancement in certain careers, potentially affecting your long-term earning potential.

6. Impact on Personal Relationships:

- Explanation: Financial stress and limitations resulting from a bad credit score could strain personal relationships, especially if financial responsibilities are shared.

- Emotional and Relational Impact: This could lead to tension and conflict, impacting overall well-being and family dynamics.

7. Reduced Financial Flexibility:

- Explanation: With limited access to credit, you may find yourself with fewer options to manage financial emergencies or take advantage of investment opportunities.

- Long-Term Financial Health: This could affect your ability to build wealth, save for retirement, or improve your financial situation.

Improving Credit Score and Financial Health

1. Maintain Regular and Timely Payments: Set up direct debits or reminders to ensure all bills, loans, credit cards, and utilities are paid on time. Consistent, on-time payments significantly influence your credit score and demonstrate financial reliability to lenders.

2. Manage Debt and Reduce Credit Utilisation: Aim to keep your credit card balances low, ideally below 30% of your available credit. Focus on paying down high-interest debts first (debt avalanche method) or starting with the smallest debts (debt snowball method) to improve your credit utilisation ratio and reduce overall debt.

3. Monitor and Correct Credit Report Inaccuracies: Regularly obtain your credit report from major credit bureaus and review it for errors. Dispute any inaccuracies to ensure your credit score accurately reflects your credit history.

4. Limit New Credit Applications: Apply for new credit only when necessary, as frequent applications can result in hard inquiries that may lower your score. Be cautious about opening new accounts or taking out new loans.

5. Educate Yourself on Credit and Personal Finance: Seek resources, courses, or counselling that offer education on budgeting, debt management, and credit usage. Understanding how credit works can help you make more informed financial decisions.

6. Utilise Financial Planning and Management Tools: Use tools and services offered by banks and financial institutions for tracking spending, setting budget goals, and monitoring your credit score. These can help you maintain control over your finances and assess the impact of your financial decisions.

7. Seek Professional Financial Advice: If you’re struggling to manage your debts or improve your credit score, consider consulting with a credit counsellor, financial advisor, or debt counselling service for personalised advice and strategies tailored to your financial situation.

8. Implement Lifestyle Changes and Financial Strategies:

- Budgeting: Create and adhere to a detailed budget that accounts for all income and expenses, helping to avoid overspending and debt accumulation.

- Emergency Fund: Build a fund to cover unexpected expenses, which can prevent the need for additional borrowing in emergencies.

- Income Enhancement: Explore opportunities to increase your income, such as part-time jobs, freelancing, or selling unused items.

- Expense Reduction: Cut back on non-essential spending to allocate more towards debt repayment and savings.

9. Explore Legal and Financial Adjustment Options: In cases of severe financial distress, consult with a legal professional about debt relief options like bankruptcy or insolvency. These measures have significant implications and should be considered as last resorts.

10. Practice Patience and Consistency: Improving your credit score is a long-term endeavour that requires persistent and responsible financial behaviour. Stay committed to your financial health, monitor your progress, and adjust your strategies as necessary.

Monitoring Your Credit Score with UK Agencies

Regularly monitoring your credit score with agencies like Experian, Equifax, and TransUnion could provide insights into your financial standing and help you make informed decisions. Each agency offers the opportunity to view your credit score and report, often with additional resources to help you understand and improve your credit rating.

Conclusion

Understanding what a bad credit score is and its implications is essential for financial wellbeing in the UK. By recognising the factors that affect your credit score and taking proactive steps to manage it, you could improve your financial standing and access better credit opportunities.

Here at Go Car Credit, we are specialists in bad credit car finance. We understand that everybody’s credit rating and circumstances are different. We want to help you find a car that suits your needs and is affordable, even if you have had bad credit in the past. Not only that, but we also understand that with previous bad credit, obtaining a car loan can be a daunting task, so we are here to help.