Rates from 29.7% APR

40.9% Representative APR -

Subject to status and affordability

If you’re looking to get a new set of wheels on finance but have a poor credit history, then hire purchase cars for bad credit are a simple and accessible option. It could even help you rebuild your credit score. At Go Car Credit, we specialise in helping people with bad credit secure hire purchase finance for their next car.

We’re not a third-party provider or finance broker, so when you take out a hire purchase car finance agreement with us, you’ll deal with our friendly and professional team throughout. Read on to find hire purchase explained and discover if it could be right for you, regardless of a bad credit rating.

Representative example – Total amount of credit £9,000, annual interest rate 21.75% (fixed), charge for credit £10,092.32 (£9,787.32 interest, £295 admin fee and £10 option to purchase fee), total amount payable £19,092.32. Loan term of 60 monthly instalments, 59 payments of £318.04 and 1 final instalment of £328.04. 40.9% Representative APR – Subject to status and affordability

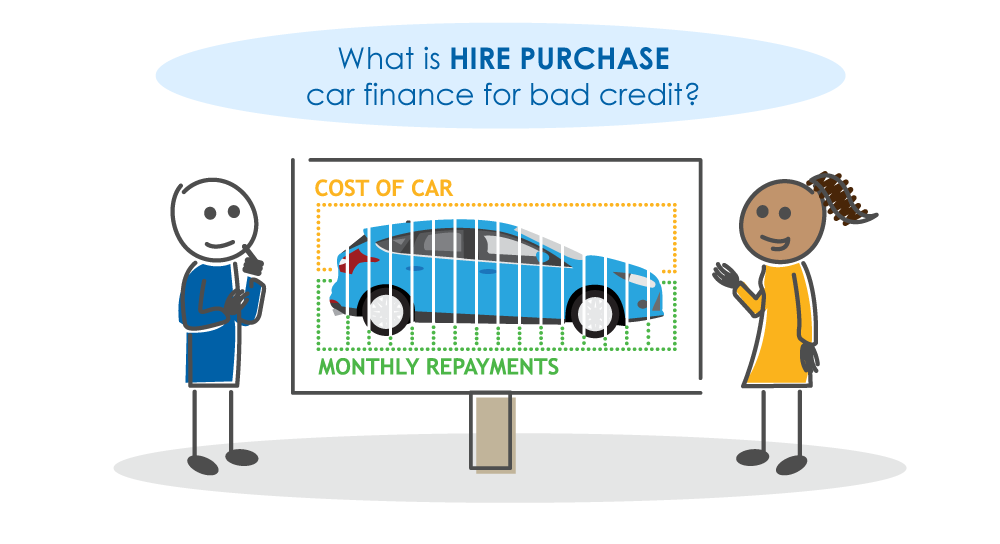

A simple definition of hire purchase (sometimes known as HP) is that you pay to hire a car over a period of time before eventually having paid enough to own it outright. It’s one of the most common types of finance used to acquire a car, and one of the most straightforward to understand.

You may pay a deposit on your chosen vehicle before hiring it for an agreed term. You’ll make fixed repayments along the way until you’ve paid off all the agreed finance, typically the total price of the car plus the amount of interest. The lender owns the car up until this point, then it’s all yours.

At Go Car Credit, we’ll agree all your hire purchase finance costs up front to give you total transparency from start to finish. There are no nasty surprises at the end of your agreement such as balloon payments or mileage restrictions. It’s a sensible borrowing option that could help you get back behind the wheel.

Getting a traditional loan for a car can be tricky if your credit score isn’t what it could be. But that doesn’t mean you have to give up hope. Hire Purchase is an ideal form of car finance if you struggle to get other forms of credit such as personal loans, have a poor credit history or don’t want to pay cash for a vehicle.

Unlike a personal loan, hire purchase car finance is secured against the value of the car itself. This means that if you run into difficulty and become unable to keep up the repayments, the lender can repossess the car and get their money back this way.

Having this option available reduces the level of risk for the lender and makes this type of car finance more accessible to people like you. So even if you’ve already been turned down for a normal loan, you could still apply for hire purchase cars with bad credit with an alternative company like Go Car Credit.

If you’re currently weighing up your options for purchasing your next vehicle, we’re here to help you make the right decision. Beyond owning the vehicle at the end of the agreement, the key pros of hire purchase finance are that it’s:

If a deposit is required, this figure is typically very low depending on the car.

As with any type of personal finance, there are a few factors to consider before deciding if hire purchase for bad credit is the right option for you.

The rate and terms you’ll be offered for hire purchase with poor credit will ultimately depend on a few factors, including your credit score and the size of your deposit.

As specialists in bad credit car finance, we’ll give you a decision based on a review from a real person on our team, not just a computer-generated score. We’ll look at your current financial situation to work out a personalised repayment plan that is affordable once all your outgoings are accounted for. You can use our bad credit car finance calculator to get a rough idea of what your repayments could be.

As well as the regular money management tips shared in our guides section, there are steps you can take to improve your credit score before applying:

There are some circumstances when we will ask you for a deposit. For example, if your maximum loan amount is £7,000 and the vehicle’s asking price is £7,200, you’ll need to pay a £200 deposit.

We offer our customers black box car finance, which means adding a discreet Payment Reminder System to the vehicle. This allows us to provide a broader lending criteria than many other direct lenders, and we take into account all incomes, including from benefits and self-employment.

You may have been looking for car finance with no credit check or an instant decision, as a responsible lender we look at each application on an individual basis and will do our very best to get you approved.

We have made our Car Finance process as simple and straightforward as possible for you:

We can all have problems getting credit from high-street banks. Therefore, Go Car Credit set out to give you the green light. Here are six reasons to go ahead with us:

We provide hire purchase cars for bad credit across the UK through a network of trusted car dealers. Call our friendly team on 01925 696 373, they’ll be happy to answer any further questions about how it all works.

Going into a bank to apply for a loan for a car can feel intimidating. And, so can filling out reams of paperwork, too. With Go Car Credit, applying for hire purchase with bad credit couldn’t be easier.

Enter a few personal details into our secure online application form in a matter of minutes. Once we’ve given you a decision, we’ll ask for some details on your vehicle of choice before asking for you to give an online signature if you want to go ahead. There’s no charge for making an application and no obligation, so if you change your mind and want to walk away, you can.

Apply for hire purchase finance with Go Car Credit today!