To change the loan amount or loan period - press/click to hold the car, then slide it left or right and let go.

(You can also tap/click the plus+ and minus- buttons to change them too)

Representative example – Total amount of credit £9,000, annual interest rate 21.75% (fixed), charge for credit £10,092.32 (£9,787.32 interest, £295 admin fee and £10 option to purchase fee), total amount payable £19,092.32. Loan term of 60 monthly instalments, 59 payments of £318.04 and 1 final instalment of £328.04. 40.9% Representative APR – Subject to status and affordability

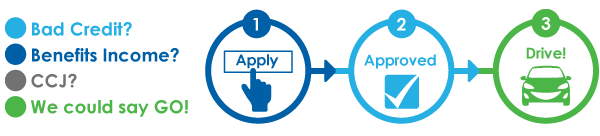

At Go Car Credit, we specialise in offering car finance solutions tailored for individuals with a history of bad credit.

We aim to help you find an affordable car that suits your needs even if you have had bad credit in the past. But we know that car finance can sometimes seem complicated. So, we created a car finance calculator to help – a free tool that will set things straight before you apply.

Our online car loan repayment calculator couldn’t be easier to use. Simply use the sliders to select the amount you want to borrow (up to £15,000) – and for how long (up to 60 months). The calculator will then do the rest, providing you with an approximate amount that you could expect to pay back each month.

There are no hidden fees or any other extras. Not comfortable with the amounts shown? You can simply readjust the sliders on our car loan calculator. That way, you’ll be able to find the monthly payment amount that’s right for you – and, more importantly, one you can afford.

Our online car finance calculator is designed to be easy to use and just as easy to understand.

To get started, it’s often advisable to have a rough idea of how much you want to pay back each month and for how long. When using our bad credit car finance calculator, you should also think about how much you can afford to repay along with your other bills and monthly costs.

Other important things to be aware of when using this tool:

Our car finance calculator is designed to give you an idea of how much it’ll cost to obtain car finance with Go Car Credit and how long it’ll take to pay back what you owe. While it can’t make any firm promises, it’ll give you a much clearer understanding of what to expect.

Some of the questions our car finance calculator can help you to answer before applying are:

The monthly amount that our car repayment calculator shows is based on – how much you’d like to borrow and for how long, together with the APR.

Using our car loan calculator, you can see how much it could cost to buy the car that’s right for you. When you apply for bad credit car finance, there will be a cost involved.

APR – annual percentage rate – is that ‘official’ cost of borrowing over a 12-month period. With this figure, you can compare all sorts of financial products such as credit cards and loans. It lets you better understand what our online car credit calculator is telling you.

A representative APR is the rate of interest that 51% of successful applicants will get.

It’s no fun being turned down for a financial product – whether it’s car finance, a credit card or something else. But it’s important to remember you aren’t alone.

Our aim is to get people back out on the road and our poor credit car finance calculator is your first step. Here are some more reasons why you can turn to us for the car finance you need:

Just because our car loan calculator suggests that you could get a deal to suit your needs with us, it’s no guarantee that you actually will. Before applying, there are a few factors that it may be worth thinking about to give you the best chance of being approved:

Our car finance calculator is designed to show you exactly how much you could be paying back each month. If you don’t have the best credit score, this can be really useful because it will let you plan your finances and make sure that you’re not taking on something you can’t afford.

If you’re accepted…

Good news – you’ll get the finance you need to find your next car.

We do have criteria that must be met, which includes maximum mileage restrictions and maximum age of vehicle restrictions.

But don’t worry – we can help you find your ideal car from one of our many trusted dealers located right across the UK.

If you’re not…

We always try to do our best to help those finding it hard to get credit.

Sadly, we can’t help everyone every time. But we will be open and honest with you if we’re not able to approve your application.

It’s best not to apply again straight away. Too many applications in a short space of time can make it even harder to be approved.

Visit our Bad Credit Car Finance page for more information on how we can help you get the finance you need for your next car purchase.

Not sure how it all works here at Go Car Credit? Find out How Our Finance Works and understand more about our car finance process.

Now our car finance calculator has given you a good idea of your budget, the next step is to apply for finance with us. Do it today in less than 2 minutes!

We would suggest you think about the costs associated with your choice of car such as fuel, insurance, tax, MOT, servicing and maintenance costs, as these will all have an influence on the affordability of the vehicle. The finance is secured on the vehicle, so if you don’t keep up with the monthly repayments, Go Car Credit can repossess the car. Failure to make payments can also affect your credit report.