Featured Article

What is specialist car finance?

September 27th 2021 by Gemma Simpson

Specialist car finance is a sub-prime vehicle loan, that could be given to people who may be seen as too high risk to... Read What is specialist car finance? »

Specialist car finance is a sub-prime vehicle loan, that could be given to people who may be seen as too high risk to... Read What is specialist car finance? »

Find out how to secure car finance with our informative guides.

From learning the difference between Hire Purchase and Personal Contract Purchase to understanding more about securing car finance with poor credit, our collection of car finance guides will help you better understand the ins and outs of financing a vehicle.

There’s nothing quite like that feeling of getting a new set of wheels on finance. We think you should be able to enjoy... Read What You Can And Can’t Do During A Car Finance Agreement »

If you are thinking about changing your car you may have heard the term ‘negative equity.’ In this article, we help... Read Car Finance and Negative Equity »

Bankruptcy is a form of insolvency, a legal status that can be a way to clear debts you can’t pay. When you’re bankrupt,... Read Bankruptcy – Can You Get Car Finance After Bankruptcy? »

If you’re currently looking at used cars but have bad credit, loans from the bank aren’t likely to be an option for you.... Read How to buy a used car with bad credit »

Have you recently had an application for credit rejected? If so, it’s possible that you’re wondering if this will affect your credit file.

... Read How to get a car with bad credit »

While there are a number of lending options for those who don’t have good credit, it’s important to remember that when you’re exploring... Read Why bad credit finance is not suitable for all »

There is an awful lot of jargon involved in car finance, which makes it tricky to get your head around the facts of... Read Car Finance Glossary »

Annual percentage rate, more commonly known as APR, is used to help you understand the cost of borrowing. The percentage figure allows people... Read What Does APR Mean? »

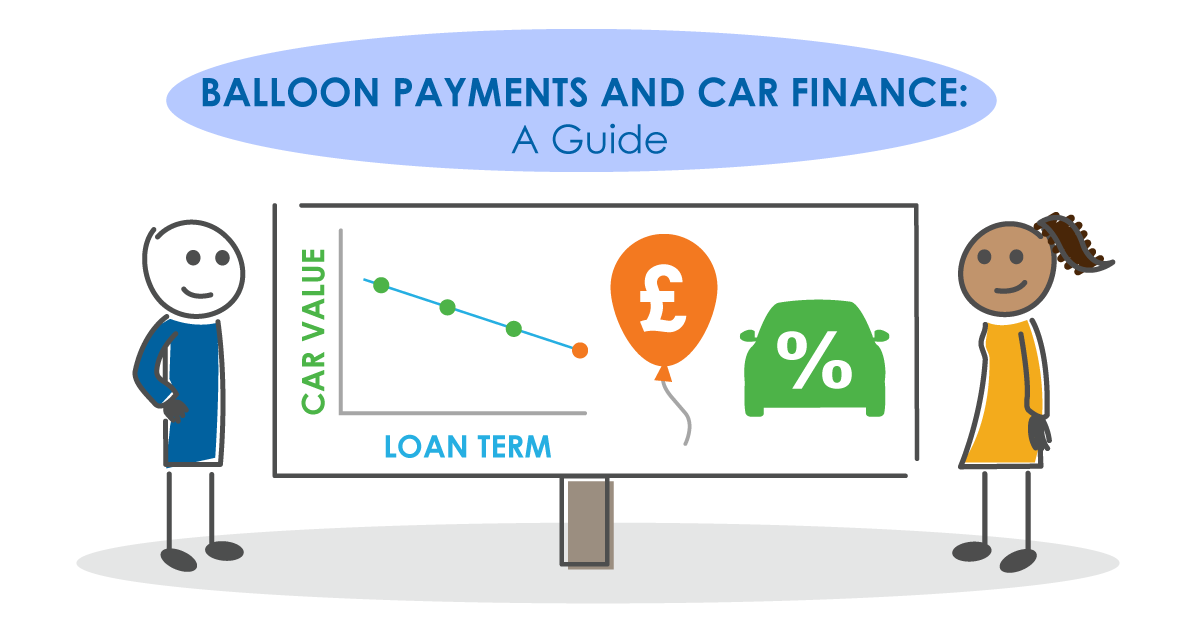

Are you thinking about a new set of wheels but unsure of the best way to finance it? There may be multiple options... Read Balloon Payments and Car Finance: A Guide »

With the current slowdown in production of new cars cluttering our news feeds it’s no wonder people are looking for older vehicles when... Read How to get car finance for older cars »

We understand that there can be many confusing elements to the car finance process. This blog post focuses on understanding what you need... Read Can you part exchange a car on finance? »

Car leasing or Personal Car Hire (PCH) is essentially entering into a policy in which you rent to use a vehicle for an... Read What is car leasing? »

With the UK Coronavirus Job Retention Scheme due to come to a close at the end of September 2021, you may be wondering... Read Can furlough prevent you getting car finance in 2021? »

When you make that all important decision to either upgrade your current car or purchase your first car, the next thing to decide... Read Car Finance Options Comparison »

Having previous bad credit should not mean you are unable to get car finance from lenders. Go Car... Read Can you afford car finance? »

Buying a car can greatly reduce your bank balance, which is why many people choose to apply for a car loan to pay... Read The benefits of getting car finance »

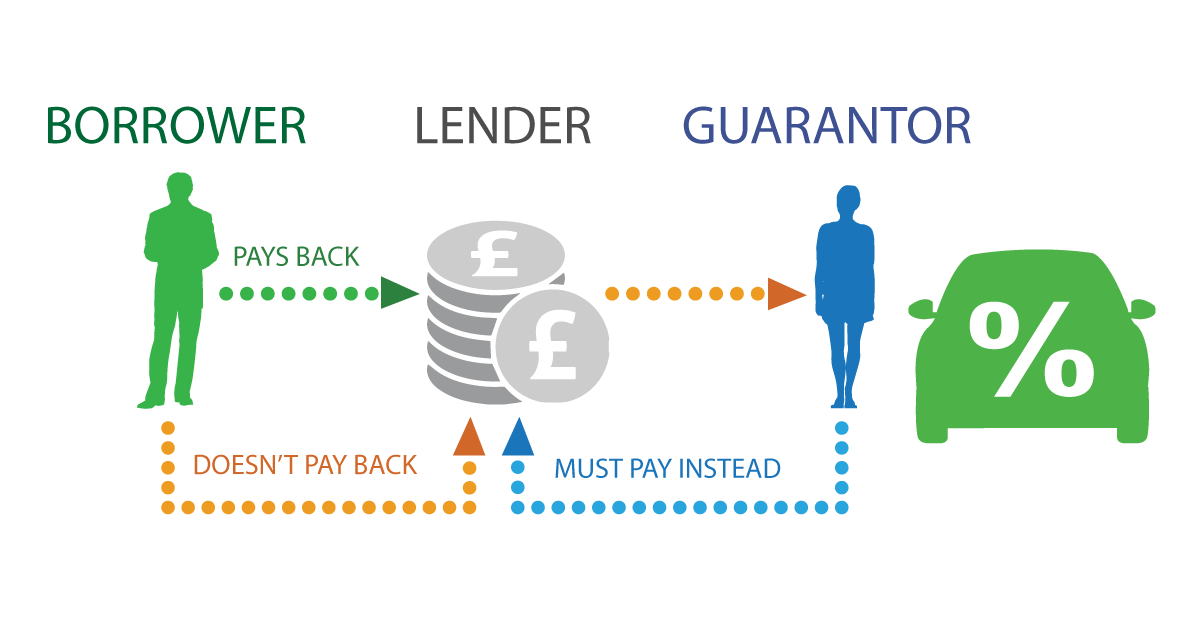

Are you considering a guarantor loan or becoming a guarantor yourself? Take a look at the below information which will help you understand... Read What is guarantor car finance? »

Rates from 29.7% APR, 40.9% Representative APR - Subject to status and affordability.