Featured Article

How to repair credit

July 6th 2023 by Olivia Collins

You don’t have to put up with the dark cloud of bad credit hanging over you as you make your way through life... Read How to repair credit »

You don’t have to put up with the dark cloud of bad credit hanging over you as you make your way through life... Read How to repair credit »

Credit plays an important role in car finance eligibility. To get you on the road, we’re here to help explain more about the role that credit can play and what you can be doing to improve your financial reputation.

Explore our guides on credit scores, building up your credit file and what it means for your financing eligibility if you have poor credit.

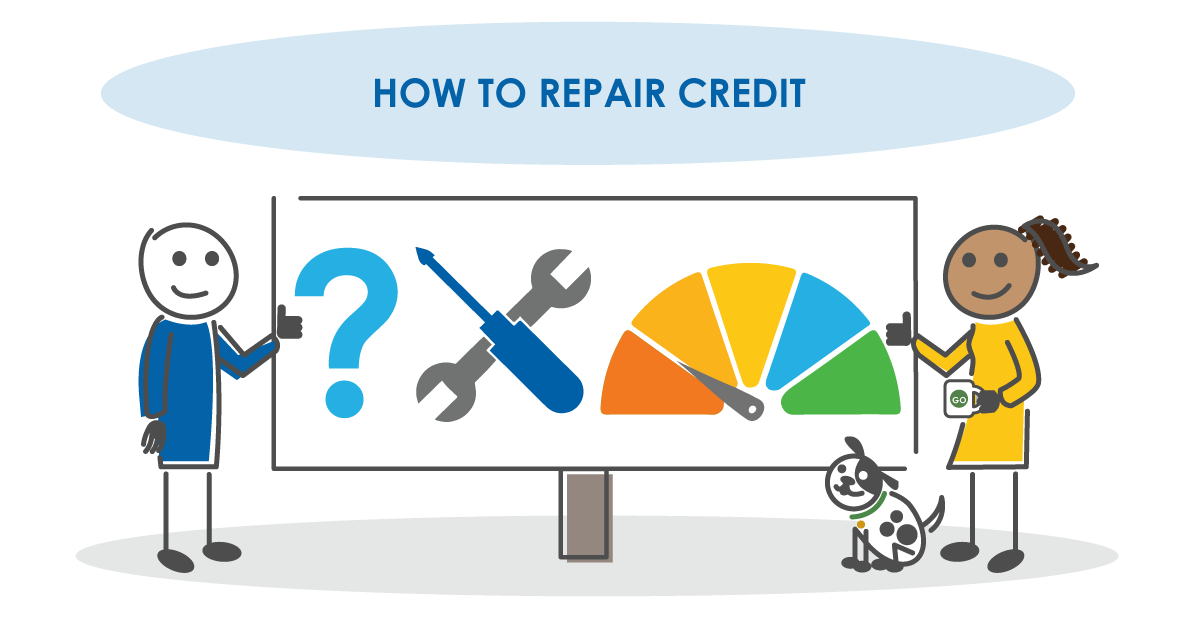

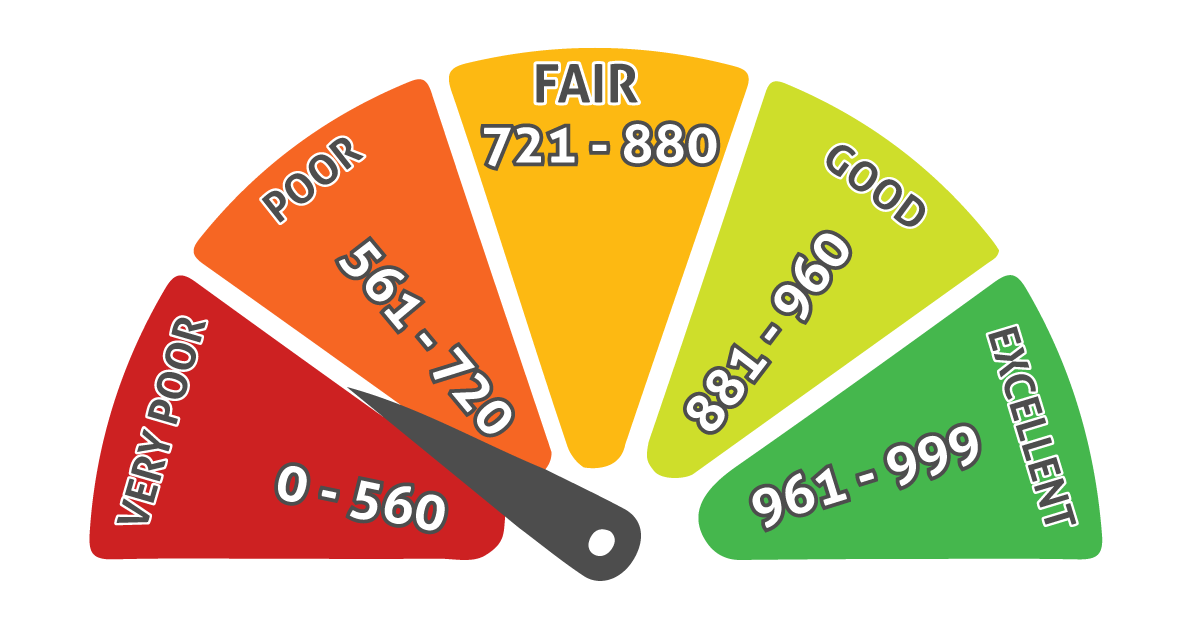

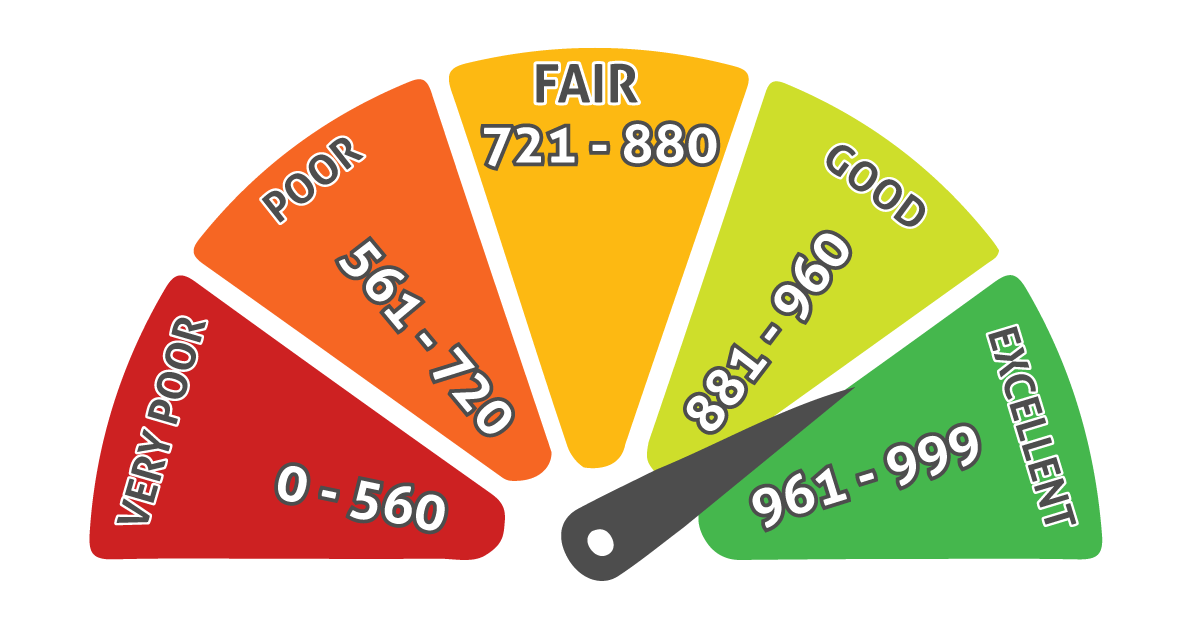

In the financial landscape of the United Kingdom, a credit score is a key indicator of your financial health. It’s a numeric representation... Read What is a Bad Credit score? »

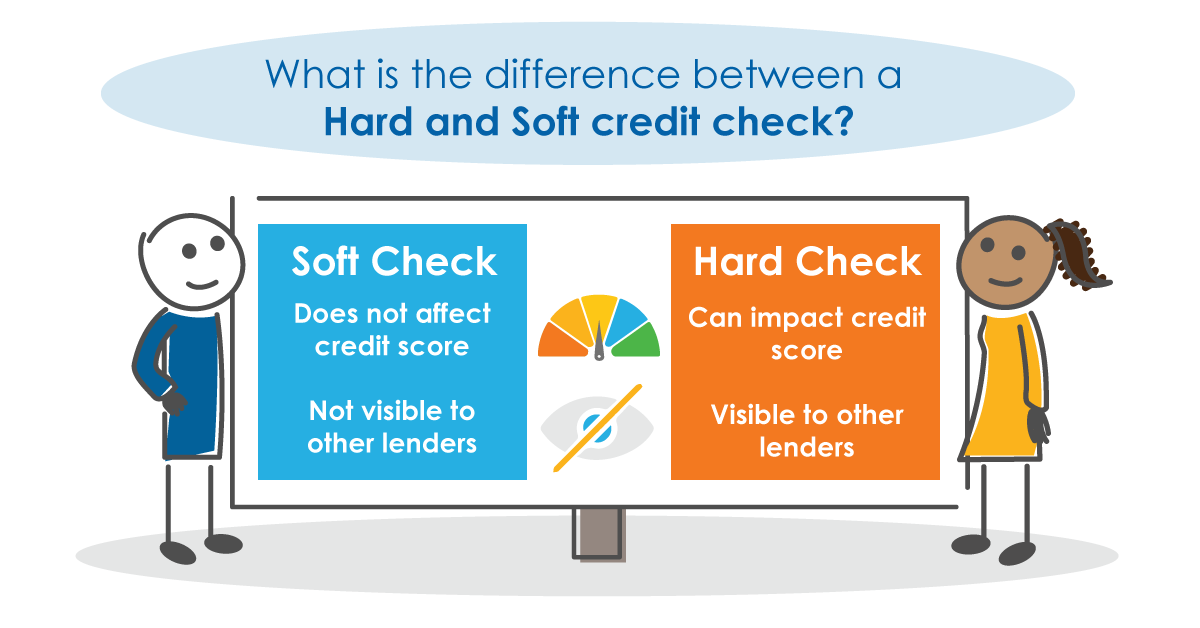

Navigating the financial landscape often involves understanding a range of terminologies and procedures, two of the most common being hard and soft credit... Read What is the difference between a Hard and Soft credit check? »

A good credit score can change depending on the credit reference agency used. Experian, Equifax, and TransUnion are the most used credit reference... Read What is a Good Credit Score? »

Welcome to our infographic guide on understanding credit. In this guide, we will help explain the basics about credit – what it is,... Read What is Credit? Infographic »

Do you want to apply for car finance and don’t know what your credit profile looks like? Or have you recently been declined... Read Review your Credit Profile »

There is no definitive minimum credit score requirement to get approved for car finance when buying a car. However, the relationship between credit... Read What credit score is needed for car finance? »

When you apply for a car loan, the lender will look at your credit history to determine whether to risk giving you credit.... Read How do lenders use my credit information? »

Have you ever wondered how credit started in the UK and how different it is today compared to the past?, we have put... Read The history of credit in the UK infographic »

There are two types of bad credit, one is defaults showing on your credit report from missed payments, due to the impact of... Read What type of bad credit do you have? »

Can you get blacklisted for all credit? — A credit blacklist (a list of people or things that are regarded as unacceptable or... Read Credit myths and the truth behind them »

Building a good credit score, also known as a credit rating, can affect your ability to borrow money or get products such as... Read How long does it take to improve my credit score? »

Financial exclusion is a way to describe someone who has either the inability to access credit or is having difficulty accessing mainstream financial... Read Bad Credit and Financial Exclusion »

Check out MoneyHelpers article below on how to get out of debt – by someone who’s done it. MH asked Hayley, who runs... Read How to get out of debt – by someone who’s done it »

You may have have heard of the FCA but do not know much about what they do and how it can help you.... Read Who are the FCA and what does that mean for you? »

Have you heard the terms ‘secured loan’ and ‘unsecured loan’ but not really known what they are and what the difference is? As... Read What is the difference between a secured loan and an unsecured loan? »

Rates from 29.7% APR, 40.9% Representative APR - Subject to status and affordability.