Welcome to our infographic guide on understanding credit. In this guide, we will help explain the basics about credit – what it is, its various forms, why it matters, and how it affects your financial life. By the end, you’ll have a solid grasp of credit and how to use it to your advantage.

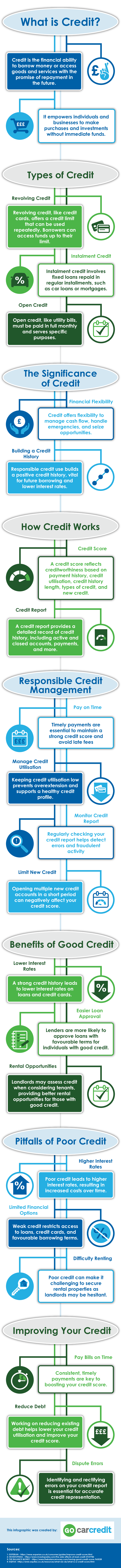

1: What is Credit?

Credit is a financial tool that empowers individuals and businesses to access funds for purchases, investments, or emergencies, even when their immediate cash reserves fall short. It’s like a financial bridge that allows you to bridge the gap between your financial needs and your available resources.

2: Types of Credit

- Revolving Credit: Revolving credit, often associated with credit cards, provides you with a predetermined spending limit that you can use, repay, and reuse as needed. It’s like having a cushion of available funds that you can tap into whenever necessary.

- Instalment Credit: Need to make a significant purchase? Instalment credit is your ally. With this type of credit, you borrow a fixed amount and agree to pay it back in equal instalments over time. This structured approach ensures that you’re able to manage your payments effectively while enjoying the benefits of your purchase.

- Open Credit: Imagine open credit as a pay-as-you-go arrangement. Whether it’s utility bills or specific services, you use what you need and settle the full amount within a defined period. It’s a responsible way to ensure that you stay on top of your financial obligations without accumulating long-term debt.

3: The Significance of Credit

- Financial Flexibility: Life is full of surprises, and financial emergencies are no exception. Credit serves as your safety net during unforeseen circumstances. Unexpected repairs, having access to credit can be a lifesaver, allowing you to address immediate needs without disrupting your overall financial stability.

- Building a Credit History: Think of your credit history as your financial reputation. Just like trust is built over time, your credit history reflects your financial responsibility and reliability. A positive credit history not only paves the way for better borrowing terms but also opens doors to various financial opportunities.

4: How Credit Operates

- Credit Score: Your credit score is like a numerical reflection of your creditworthiness. It takes into account factors such as your payment history, credit utilisation, length of credit history, and types of credit accounts. Lenders use this score to assess the level of risk when considering your loan or credit card application.

- Credit Report: Your credit report is a detailed record of your credit activities. It includes information about your open and closed accounts, payment patterns, and any negative marks. Regularly reviewing your credit report helps you stay informed about your financial health and detect any errors that need to be addressed.

5: Responsible Credit Management

- Pay on Time: Timely payments are the backbone of a healthy credit profile. Consistently meeting payment deadlines not only prevents late fees but also demonstrates your commitment to honouring your financial obligations. This positive payment history contributes to a strong credit score.

- Monitor Credit Report: Your credit report is your financial mirror – it reflects your credit activities and their impact. Regularly checking your credit report allows you to identify inaccuracies, address potential issues, and maintain the accuracy of your credit history.

- Manage Credit Utilisation: Your credit utilisation ratio, or the amount of credit you’re using compared to your total available credit, plays a significant role in your credit score. Keeping this ratio low signals responsible credit management and enhances your creditworthiness.

- Limit New Credit: While new credit opportunities can be tempting, opening multiple new accounts in a short span may raise concerns for lenders. Exercise caution and make informed decisions when considering new credit options.

6: Benefits of Good Credit

- Lower Interest Rates: A strong credit history can lead to lower interest rates on loans and credit cards. This means you’ll pay less in interest over the life of your loans, saving you valuable money.

- Easier Loan Approval: Lenders are more inclined to approve your loan applications when you have a positive credit history. This approval process becomes smoother, and you’re more likely to enjoy favourable borrowing terms.

- Rental Opportunities: Landlords often check your credit history when considering you as a tenant. A positive credit history enhances your credibility, making it easier to secure your desired rental property.

7: Pitfalls of Poor Credit

- Higher Interest Rates: Poor credit can lead to higher interest rates on loans and credit cards. This means you’ll end up paying more in interest, which can strain your financial resources over time.

- Limited Financial Options: A lower credit score may limit your access to various financial opportunities. You might find it challenging to secure loans or credit lines, and the terms you’re offered may be less favourable.

- Difficulty Renting: Poor credit can impact your ability to rent a home or apartment. Landlords often consider credit history when evaluating potential tenants, and a negative credit history might lead to rental difficulties.

8: Improving Your Credit

- Pay Bills on Time: Consistent on-time payments have a significant positive impact on your credit score. Set up reminders or automatic payments to ensure you never miss a due date.

- Reduce Debt: Gradually paying down your existing debts not only improves your credit utilisation but also showcases your commitment to responsible credit management.

- Dispute Errors: Mistakes can happen, and they might negatively affect your credit report. If you spot any inaccuracies, take steps to dispute and correct them promptly.

We hope this guide has helped you learn more about the world of credit. Remember, credit is a powerful tool that can either work for or against you – it all depends on how you manage it. By understanding credit and practicing responsible credit habits, you’re well on your way to a more secure financial future.