Car leasing or Personal Car Hire (PCH) is essentially entering into a policy in which you rent to use a vehicle for an agreed amount of time. Leasing can be a convenient option for drivers that cannot afford a large outright purchase or who like to change their cars regularly.

However, there are some considerations around vehicle leasing that all drivers should be aware of.

How does car leasing work?

With car leasing effectively being a long-term rental, you never actually own the vehicle, even at the end of an agreement. Very few manufacturers and finance providers allow leased cars to be purchased. Instead, you are usually presented with an option to continue with a new agreement or purchase from an alternative provider.

While finance companies technically own the vehicle throughout the lease agreement, drivers are still expected to maintain and care for the vehicle for the duration of the policy. Depending on the terms and conditions this can also include yearly MOT and service checks. Once the lease agreement comes to an end the car is then returned to the leasing company.

Each leasing agreement is typically arranged around a fixed monthly fee as well as an upfront deposit and can last between 24, 36 and 48 months. The price you pay per month depends on a number of factors such as:

- Make and model of a car

- The overall costs of the vehicle

- The agreed annual mileage

- The length of contact

- Any estimated depreciation during the term of your policy

When researching your options for purchasing a new car it’s good to take a look at information available and ensure that car leasing as an option is right for you and your situation over the next 3 to 4 years.

What are the benefits of leasing a car?

With leasing, you only pay for the difference between the purchase price and the residual value (the predicted value of the car) at the end of the lease.

Unlike a PCP or HP, there is no interest included, and unlike buying, you are not paying for the whole vehicle.

This means you could be able to afford to drive a more expensive vehicle on the same monthly budget.

Getting to drive the latest car is a luxury many motorists can’t afford because it simply is not affordable. But with leasing, you can have a brand-new vehicle every few years and get access to regular upgrades.

Regularly updating your vehicle to the latest model means you can avoid the costs associated with driving an older car too. Newer cars tend to experience fewer problems, but with leasing, any issues would usually be covered under the warranty.

What does car leasing Include?

Insurance is not usually included in your lease deal. You will be required to get a fully comprehensive insurance cover for your lease car. There are some deals that may include insurance but more often than not you will be responsible for this additional cost.

Your car lease deal will usually include the road tax but double check the finer details to make sure this is the case.

Because the vehicle is usually brand new it will come with a manufacturer’s warranty. That would usually be 3 years but double check those details as some offer more.

Leasing or car finance?

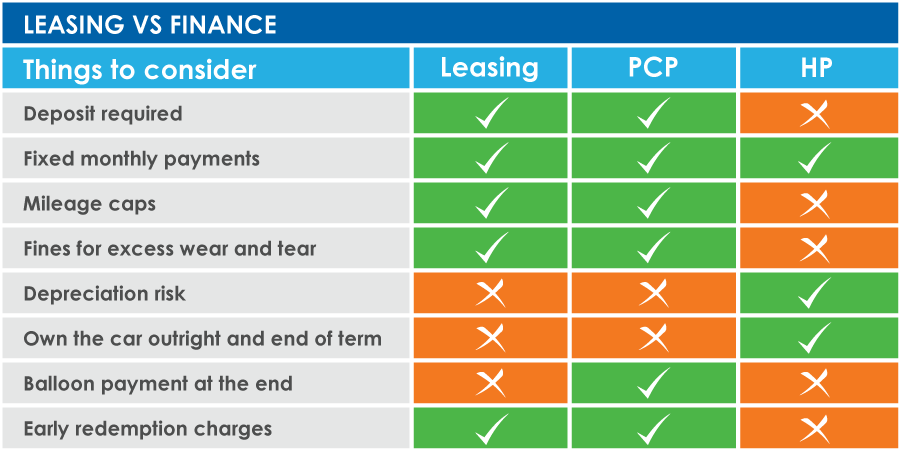

Check out the table below of things to consider when comparing leasing, PCP finance or hire purchase car finance so you can see what option may be more suitable to your circumstances.

Does Go Car Credit offer Car Leasing?

Here at Go Car Credit we do not offer car leasing. We offer Hire Purchase Car Finance.

At Go Car Credit, we specialise in helping people with bad credit get behind the wheel and onto the open road. Find out if hire purchase (HP) car finance could be the perfect option for you.

Take a look further at our range of resources that explain what we offer and how we could help you with your next car purchase. Alternatively, if you are ready to start your car finance journey with us apply today it takes less than 2 minutes.

What other options are there other than car leasing?

Hire purchase car finance gives people the chance to buy a vehicle without having to pay for the amount in full before they can drive it. You hire the car from the finance provider for a set amount of time and your agreement will be secured against the vehicle itself. That means the car is legally owned by the lender and you will be the registered keeper while you make fixed monthly payments across a set amount of time. Once you have paid the car’s price in full, plus an amount of interest together with the option to purchase fee, the car will be yours and you become the legal owner.

Personal contract purchase or PCP is where you will be paying off the value of the depreciation of the car, not the full value of the car. At the end of the agreement, if you decide you want to keep the car, you’ll need to pay what’s known as a ‘balloon payment’. This covers the cost of the vehicle and transfers ownership from the finance company to you. If you don’t want to keep the vehicle or don’t have the money to pay off the balloon payment you can give it back, or start a new PCP deal and get a new car.

For more information on the options that could support your next car purchase please visit our blog post: Car Finance Options Comparison.

FAQ’s

Monthly Payments

Your monthly payments should remain the same through the duration of your financial agreement except for the deposit which is generally a higher one off payment.

What does initial payment mean when leasing a car?

An initial lease payment is a sum you pay upfront. This is taken off the total cost of the lease – the remaining amount will be spread out over the length of the contract term, which you will pay off in fixed monthly instalments.

Do I legally own the car?

No. During a lease agreement, vehicles are owned by the policy provider. However the driver’s name should appear as the primary user on any registration documents. Once the lease is over the car is handed over.

Is there a mileage limit?

Yes, mileage limits are agreed upon and factored into your vehicle policy monthly repayments with higher miles incurring larger costs. Exceeding your car mileage limit could result in additional costs at the end of the month.

What vehicles can I lease?

You can get most types of car on a lease contract from compact city cars, hatchbacks to family SUV’s. It is worth doing your research and being flexible with the type of car you want as you could find some great deals on particular brands and models.

Can I get my car delivered to a home address?

This depends on the supplier. Some will offer free UK delivery while others may require you to pick a car up from a dealership. In the majority of cases, vehicles are driven to your chosen handover address, although it can be useful to give the car a final check yourself before driving away.

Do I have to tax a leased car?

The leasing company is the registered keeper with the DVLA. It is their responsibility to ensure the vehicle is taxed while registering a leased vehicle and throughout the contract. Do check the details associated with your agreement to ensure this is the case.

Am I responsible for servicing?

With most vehicle leases, the policy holder is responsible for maintaining the vehicle which includes servicing. However, it is worth seeing if your provider can offer you a deal on servicing over the length of the agreement.

Who looks after the yearly MOT?

Vehicles younger than 3 years old do not legally require an MOT. This means if you opt in for a brand new car and your lease agreement lasts 3 years, you do not have to carry out an MOT.

For lease agreements with cars older than 3 years, the policy holder is responsible for organizing the yearly MOT check.

When leasing a car how does car Insurance work?

As the policy owner, you are responsible for vehicle insurance during the entire lease agreement.

What happens at the end of a car lease agreement?

Once your vehicle lease policy ends you must return the car to the lease provider. At this point, it is up to you whether to enter into a new vehicle agreement or choose an alternative purchasing method.

Can I return the car early?

You can end a car leasing agreement at any time, but depending on how much has been repaid, and how your payments are structured, the financial penalties could be harsh. If you are struggling to meet your payments you should let your finance company know straight away, as they may be able to help.