We understand that the car buying process can be stressful and full of jargon. We want to help you understand the options that may be available to you and enable you to buy your perfect car in a way that suits your circumstances.

The below article explains what PCP Car Finance is and why it may be a suitable form of finance for you to purchase your new car.

What is PCP car finance?

Personal contract purchase (PCP) is a loan to help you finance a car. But unlike a normal personal loan, you won’t be paying off the full value of the car and you won’t own it at the end of the deal (unless you choose to pay the final balloon payment).

How does PCP car finance work?

PCP Car Finance can be broken down onto 3 main elements:

- The deposit: Some dealerships may offer ‘deposit contributions’ of £500-£2,000 or more if you’re buying a new car but only if you take their finance. The larger the deposit, the less you’ll have to borrow. The norm is usually around 10% of the car’s sale price.

- The amount you borrow: The amount you’ll borrow is calculated by the car’s predicted loss in value over the term of the agreement, minus the deposit you’ve put down. You’ll pay this amount off during the deal, plus interest. So, you’re not paying the full value of the car off.

- The balloon payment: This is the large final payment you pay if you want to own the car. Also described as the Guaranteed Future Value (GFV), this is how much the dealer anticipates your car to be worth after your finance agreement ends, and is agreed at the start of your deal. You don’t have to pay this, as you could hand the car back at the end of the agreement, but it is the sum you’ll pay if you want to keep the car.

How does a typical PCP contract work?

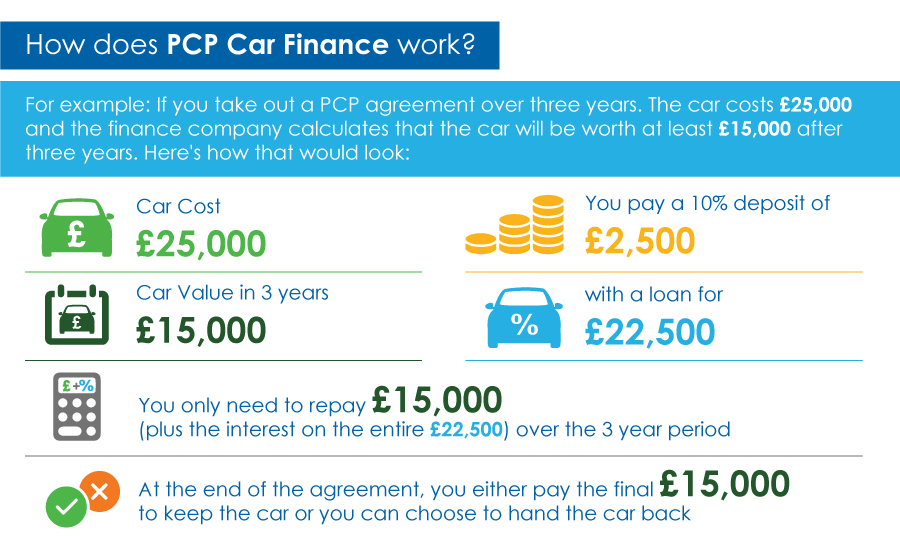

To help explain, if you were to take out a PCP agreement for a car worth £25,000 over three years it could work as follows:

- The car costs £25,000

- You put in a 10% deposit of £2,500 to secure a loan of £22,500

- The car finance lender calculates that in 3 years’ time the car will be worth £15,000

- You will only repay £15,000, plus the interest charged of the full £22,500, over a three year period.

- At the end of the period you can either pay the balloon payment or hand the car back.

How does PCP work at the end of the term?

You’ve several options at the end of your agreement – you can buy the car if you want to by paying the balloon payment, hand the car back and walk away or trade it in and use it as your deposit for the next agreement.

How does PCP work when changing car?

At the end of your PCP finance agreement, you have the option to trade in the car, using the car as a deposit to choose a different car.

As personal circumstances can change, you may find yourself in a situation where you need to change your car before the contract comes to an end. In this case, you will need to contact your lender to discuss the terms.

Benefits of PCP car finance

- Lower monthly repayments compared with other finance options such as hire purchase, leasing, and personal loans.

- You don’t need to worry about the future trade-in or resale value of the car, as the lender guarantees your car will be worth a minimum sum at the end of the deal.

- You have the option to buy, trade in or walk away at the end of the term.PCP may let you buy a more expensive car than you might otherwise be able to afford but with monthly payments to suit your budget, because you are only financing the depreciation of the car rather than the full value.

- As PCP deals are usually only offered on new or nearly new cars, you don’t have to worry about an old car that’s likely to need money spent on costly repairs.

Limitations of PCP car finance

- You will have to make a decision at the end of the agreement as to whether you wish to return the car, trade it in to get a new car, or keep it.

- If you wish to keep the car and own it, you will need to have some cash to settle the balloon payment at the end of the agreement.

- A charge can be made for damage to the vehicle (not fair wear & tear).

- A charge will be made for excess mileage if the contract mileage is exceeded. It’s important you can predict your future mileage otherwise you could end up being stung with a large excess mileage bill.

Does Go Car Credit offer PCP car finance?

Here at Go Car Credit we do not offer PCP car finance. We offer Hire Purchase car finance to people who may have been declined by mainstream lenders. For more information on what Hire Purchase car finance is and why it may be a suitable way to assist with the purchase of your new car visit our hire purchase page.