If you have had problems with credit in the past, you might see “guarantor car finance” mentioned as an option. It can sound simple, but it means another person could be responsible for the finance if you cannot pay.

This page explains what guarantor car finance is, how it works, who could be a guarantor, and the main risks for both people. It also explains what Go Car Credit does instead, including joint car finance and our approach to bad credit car finance.

What is guarantor car finance?

Guarantor car finance is a type of car loan where a third person agrees to cover the repayments if the borrower does not pay.

In plain terms:

- You apply for car finance.

- Someone you trust agrees to be your guarantor.

- If you miss payments, the lender could ask the guarantor to pay instead.

A guarantor is not just a reference. They are usually making a legal promise, so it is important that everyone understands what they are agreeing to.

If you want an independent overview of how guarantor lending works, MoneyHelper explains it here: Guarantor loans explained (MoneyHelper).

How is a guarantor loan different from other car finance options?

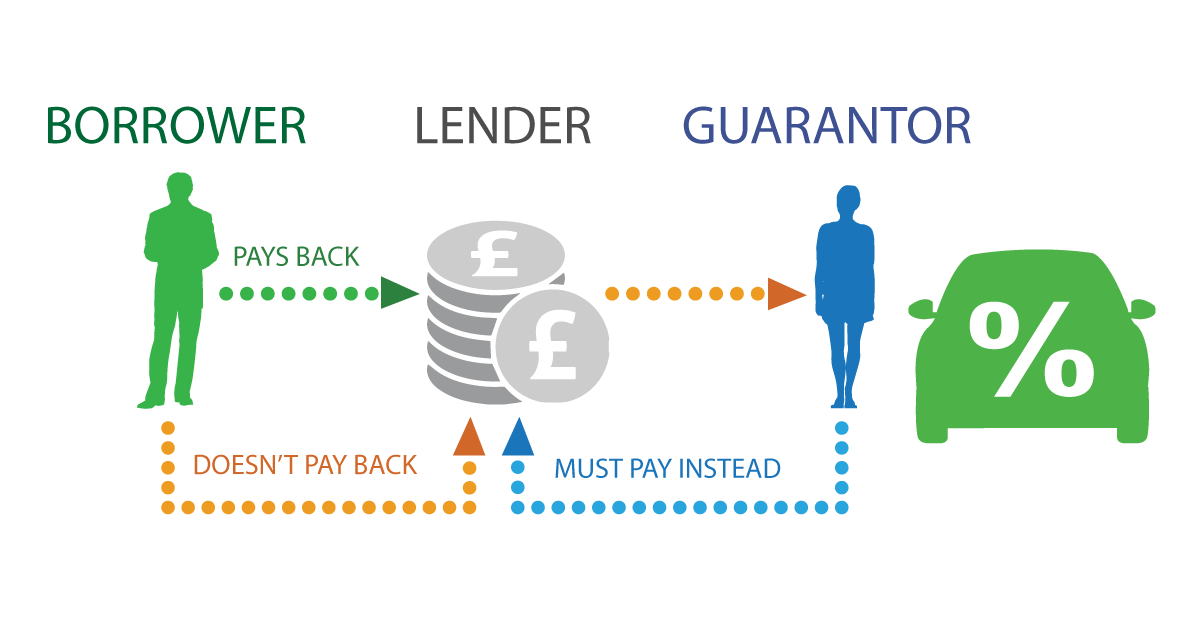

Most car finance involves two parties: you and the lender. Guarantor car finance involves three parties, which changes how risk is shared.

- The borrower applies for the finance and is expected to make the repayments.

- The lender provides the finance and sets the terms.

- The guarantor agrees to pay if the borrower does not, depending on the contract.

If you are comparing options, it may help to read how car finance works first. You can then compare that with what changes when a guarantor is involved.

Does guarantor car finance help if you have bad credit?

Some people look at guarantor options because they think it could improve their chance of being accepted when they have bad credit.

But acceptance depends on the lender’s checks, your details, and the guarantor’s details too. A guarantor does not remove affordability checks.

If you are looking into this because of past credit problems, it may help to read about bad credit car finance first. You can then decide whether you would even want to involve another person as a guarantor.

It can also help to understand the type of checks a lender may use. Some people start by reading about a soft credit check before they move forward.

Who can act as a guarantor?

Rules vary by lender, but many look for similar things. A guarantor is often someone who is:

- Over a minimum age (often 21 or older)

- Based in the UK

- In stable work, or with stable income

- With a stronger credit history than the borrower

- Able to provide proof of identity and financial details

Some lenders prefer the guarantor to be a homeowner, but not all lenders require this.

Another key point is financial links. Some lenders prefer a guarantor who is not already financially linked to you (for example, through a joint mortgage or joint bank account). This depends on the lender, so it is worth checking their rules before anyone agrees.

If you want more background before you involve someone else, our guarantor car finance guide goes into more detail.

What does a guarantor usually agree to?

A guarantor says, “If you do not pay, I will.” If you miss a payment, the lender could ask the guarantor to pay. The agreement you both sign explains what the lender could ask for.

This can be a big deal. Money can put pressure on family and friends. Things can change, such as losing work, higher bills, or an unexpected cost.

StepChange, a UK debt charity, explains guarantor loan debt in plain language: Guarantor loan debts (StepChange).

If you want a rough guide to costs, you can try different numbers in the car finance calculator.

What happens if the borrower falls behind?

If you miss a payment, the lender could contact you. They could also contact your guarantor. The lender could ask the guarantor to pay what you have missed. What happens next depends on the agreement you signed.

The FCA explains how lenders should treat guarantors and when they should contact them: FCA finalised guidance on guarantor loans (FG17/1).

If you think a lender has not been fair, the Financial Ombudsman Service explains what it could look into: Guarantor loans complaints information (Financial Ombudsman Service).

Key risks to think about

Guarantor arrangements can be a big commitment. The main risks include:

- Risk to the guarantor: they could be asked to repay the debt if you do not pay.

- Pressure on relationships: money worries can cause conflict.

- Long commitment: the guarantee may last for the full term of the agreement.

- Impact on both people: if things go wrong, both people may be affected in different ways.

This does not mean guarantor finance is always unsuitable. It does mean it needs careful thought and clear agreement from everyone involved.

Guarantor car finance vs joint car finance

These options can sound similar, but they work in different ways.

Guarantor car finance

- You take the finance in your name.

- The guarantor agrees to cover the repayments if you do not pay.

- The guarantor may not use the car, but could still be responsible for the debt.

Joint car finance

- Two people apply together.

- Both people are usually responsible for the repayments.

- It may suit couples or family members applying together, depending on circumstances.

If you are deciding between these routes, you can read more about joint car finance and compare it with how guarantor finance works.

Does Go Car Credit offer guarantor car finance?

No. Go Car Credit does not offer guarantor car finance.

We could help people who have had credit problems in the past. We do this through bad credit car finance, based on checks and what is affordable for each person.

If you decide to apply for car finance, there are a few steps the lender will follow. These steps are explained in the approval process, so you know what to expect.

Other options if you are looking at guarantor finance

If you are looking at guarantor car finance because of bad credit, it may help to look at other routes too. What suits you depends on your situation. Options could include:

- Car finance with bad credit, which is aimed at people who have had credit problems before. You will still need to pass checks.

- Joint car finance, where two people apply together. Both people are usually responsible for the repayments.

- Reviewing your credit profile first, so you can see what lenders may be looking at.

If you want a quick starting point, you can use the eligibility checker before you decide whether to apply.

Why understanding the details matters

Guarantor finance can look like a simple solution, but it is a serious commitment for the guarantor. It can affect more than one person’s finances.

If you are deciding what to do next, it helps to be clear about what you can afford. Many people find it useful to read about affordability before they take the next step.

If you would like to explore Go Car Credit, you can start at Go Car Credit. If you decide to move forward, you can apply for car finance online.

Quick summary

- Guarantor car finance means someone else agrees to pay if you do not.

- A guarantor is making a legal promise, not just helping you apply.

- Go Car Credit does not offer guarantor car finance.

- We do offer joint car finance, and we help people with bad credit, subject to checks and what is affordable.