If you are thinking about changing your car, you may hear the term negative equity. This page explains what it means, why it happens, and what you could do if it affects your next car.

What does negative equity mean

A car is in negative equity when it is worth less than the finance you still owe. This often happens because cars lose value over time. This loss in value is called depreciation.

Most cars start to lose value as soon as they are bought. This is one reason negative equity can appear early in a finance agreement. MoneyHelper explains how buying and running a car can affect its value over time.

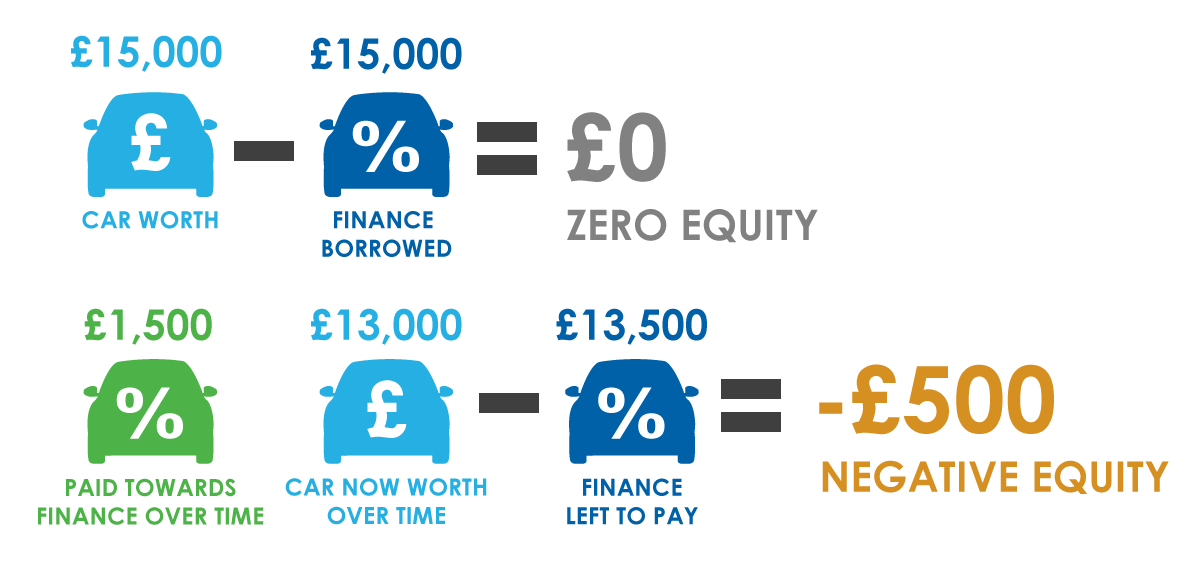

Example 1 (negative equity)

You bought a car for £15,000 and took out £15,000 of finance. The car is now worth £13,000. You have paid off £1,500. This means you still owe £13,500.

Because the car is worth £13,000 and the finance needed to settle is £13,500, there is a £500 shortfall. This is negative equity.

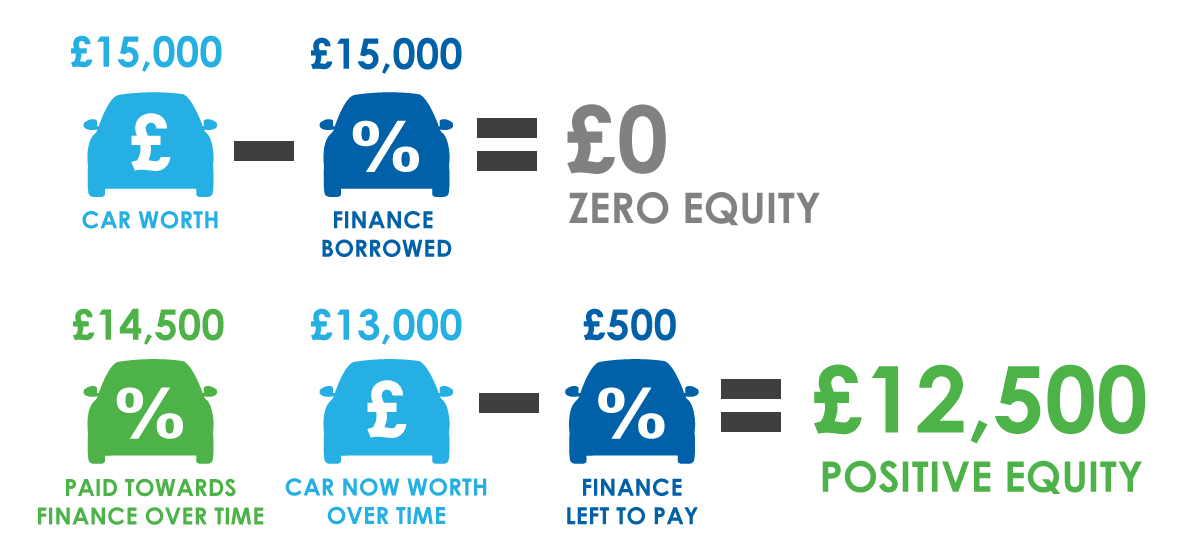

Example 2 (not negative equity)

You bought a car for £15,000 with £15,000 of finance. The car is now worth £13,000. You have paid off £14,500.

Only a small amount of finance is left to settle. Because the remaining balance is lower than the car’s value, you are not in negative equity.

You may also hear negative equity described as upside down, wrong way up, or back to front.

Why does negative equity happen

Negative equity is most common when someone wants to change their car early in the agreement. Many cars lose value fastest in the first year or two.

At the same time, the finance balance may reduce more slowly. When the value drops faster than the balance, a gap can appear.

Common reasons a gap appears

- The car loses value quickly at the start.

- The agreement term is long.

- The deposit was small.

- Extras increased the amount financed.

- Mileage is higher than expected.

- The car has damage or heavy wear.

- Used car prices fall across the market.

Staying in the agreement for longer often reduces the risk. Each payment usually brings the balance down. At the end of the agreement, there is no balance left to settle.

Negative equity and PCP

Negative equity can be more common on PCP agreements. Monthly payments are often lower. There is also usually an optional final payment at the end.

This can mean the amount owed stays higher for longer. If you want to change your car early, the settlement figure may be higher than the car’s value.

This links to the way agreements are set up in how car finance works. On PCP, balloon payments can affect how much finance remains part way through the term.

Negative equity and hire purchase

With hire purchase, there is usually no balloon-style payment at the end. You repay the full balance over the term.

This means the amount you owe often reduces in a steadier way. This can make negative equity less likely than PCP, but it still depends on the deposit, the term, and how the car holds its value.

This type of agreement is explained in our guide to hire purchase car finance.

How do I know if my car is in negative equity

To check, you need two figures.

- Your settlement figure from the finance provider.

- A realistic value for your car today.

Step 1: get a settlement figure

A settlement figure is the amount needed to clear the agreement early. You can ask your finance provider for this at any time.

The figure is often time limited, so check the date it covers. Citizens Advice explains that you can ask for an early settlement figure and that the lender must tell you what you need to pay to clear the agreement. Citizens Advice

If you are an existing Go Car Credit customer, you may be able to find account details in the Existing Customers area.

Step 2: get a fair car valuation

It helps to check more than one valuation. Trade or part exchange values are often lower than private sale prices.

Dealers need room for preparation and resale costs. Online tools also use different data, which is why prices can vary.

Auto Trader’s valuation tool shows how mileage, age, and condition can affect price. Auto Trader

If you plan to change your car through a dealer, understanding how part exchange works can help you judge whether a valuation is realistic.

A quick way to calculate negative equity

- If the settlement figure is higher than the car’s value, the difference is negative equity.

- If the settlement figure is lower than the car’s value, you have equity.

A dealer offer is not the same as a private sale price. If you plan to part exchange, compare the settlement figure to a likely trade value.

What should I do if I have negative equity

Most people have two main options.

Option 1: clear the gap

You could pay the difference yourself so the agreement can be settled. This may come from savings or by waiting until the amount is affordable.

This option can suit people who need to change their car soon and have a small shortfall.

Option 2: wait and keep paying

You could stay in the agreement and keep making payments. Over time, the balance may drop below the car’s value.

This is often the simplest option if the car still suits your needs.

Other options that may apply

Early settlement is not the only way to end a car finance agreement early. Some agreements let you return the car instead.

This is called voluntary termination. It usually applies once you have paid at least half of the total amount.

If you are struggling with payments

If payments are hard to manage, it is usually best to act early. Speaking to your lender sooner may give you more options.

Checking figures can also help. The car finance calculator can help you test amounts and plan next steps.

You can find free money advice at:

- MoneyHelper (debt guidance)

- Citizens Advice (debt and money)

- National Debtline

- StepChange Debt Charity

- GOV.UK: Get free debt advice

How do I get car finance when I have negative equity

At Go Car Credit, we are unable to take negative equity and add it onto a new finance agreement.

Many lenders take a similar view. Adding negative equity increases the amount being financed compared to the car’s value.

In most cases, the gap needs to be cleared first, or the change needs to wait.

How negative equity affects part exchange

Part exchange means using your current car as part of the deal for your next one. Even if your car is in negative equity, part exchange may still be possible if the figures work.

- The dealer values your car.

- You ask for a settlement figure.

- The finance is cleared as part of the changeover.

- If the settlement is higher than the value, the shortfall needs to be covered.

Accurate valuations matter. A small change in value can change the size of the gap. Asking what a valuation is based on can help explain the figure.

Ways to reduce the risk next time

- Choose cars that often hold their value well.

- Keep mileage close to what you expect.

- Look after the car and keep service records.

- Consider a shorter term if affordable.

- Use a larger deposit where possible.

- Avoid extras you do not need.

- Check likely depreciation before committing.