A good credit score can change depending on the credit reference agency used. Experian, Equifax, and TransUnion are the most used credit reference agencies in the UK, but they all differ in how they use credit scoring. Here, we explore the difference between Experian and Equifax credit scores to help you understand what a good credit score can look like.

What is a good Experian credit score

1121 to 1250 = Excellent

This is right at the top of Experian’s score range. With a score in this band, you’re generally seen as very low risk, so you should have access to the widest choice of credit cards, loans and mortgages. That said, approval isn’t guaranteed, and lenders still look at your full application.

1001 to 1120 = Very Good

A score in this range is usually viewed as low risk. You should be eligible for most credit cards, loans and mortgages, although you might not be offered the very best rates or deals available.

861 to 1000 = Good

This sits in the middle of the range. You should see a wide selection of credit options, but you may need to pay a bit more interest than someone with a Very Good or Excellent score.

641 to 860 = Fair

With a Fair score, your options might be more limited. You may see higher interest rates and lower borrowing limits. Improving your score could widen your choices over time.

0 to 640 = Low

This is the lowest band on the scale. Borrowing may be more difficult and interest rates could be high. Small improvements could still make a difference, and your options should improve as you move closer to the Fair range.

What is a good Equifax credit score?

Previously, the Equifax credit score scale ranged from 0 to 700 and was organised into five bands: very poor, poor, fair, good and excellent. However, Equifax revamped its credit scoring in 2021 to reframe its scoring categories and numbering.

The Equifax credit scoring guidelines are now as follows:

811 (and above) = Excellent

This score is at the top end of the Equifax scale, and most lenders would regard people in this category to be very low risk. People in this category have a positive history of credit that could have been built up by paying bills on time and not missing payments.

671-810= Very Good

People who have a score of between 671 and 810 would most likely be viewed as low-risk by lenders.

531-670 = Good

Having a score between 531 and 670 means you’d be a moderate risk for lenders.

439-530 = Fair

Those with a credit score of between 439 and 530 would be classed as high-risk by finance lenders.

0-438 = Poor

These scores are at the lowest end of the table, and people that have a credit score of between 0-438 are likely to be classed as very high risk by lenders. This is because lenders would expect those falling into this category to have severe problems with repaying debts.

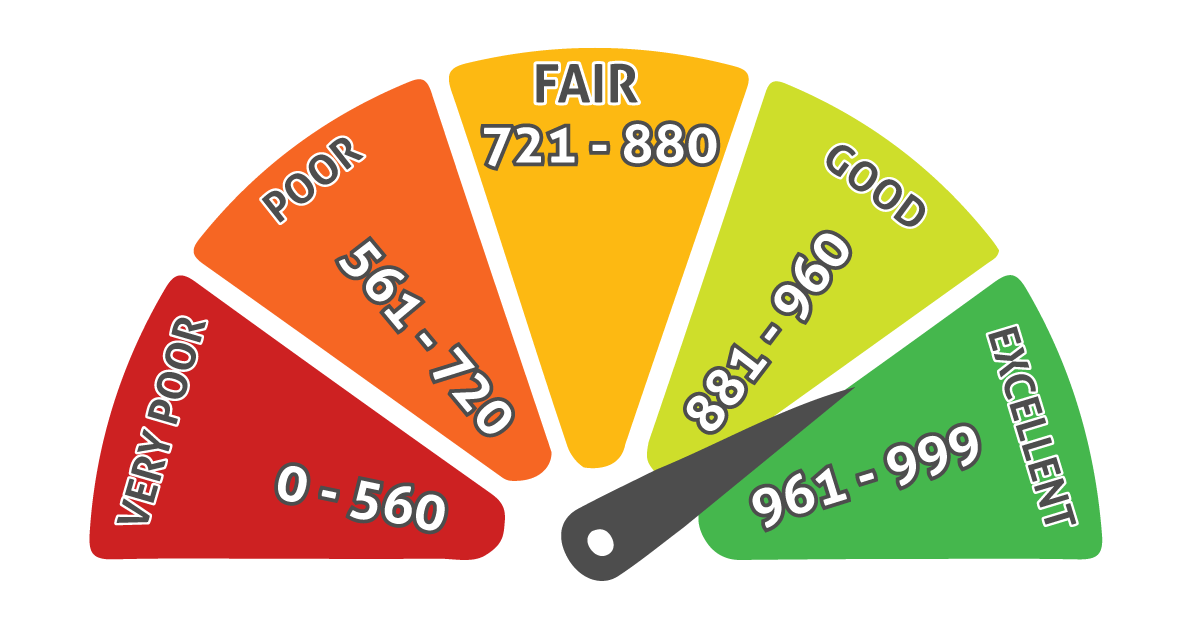

What is a good TransUnion credit score?

TransUnion credit scores go up to 850, which uses the VantageScore 3.0 as a way of scoring.

- 781-850 = Excellent

- 721-780 = Good

- 661-720 = Fair

- 601-660 = Poor

- 300-600 = Very poor

Do I have a bad or good credit score?

Lenders may only use your credit scores as part of their decision-making process. Ultimately, they will assess your creditworthiness and affordability, which is a combination of how you have paid off previous credit commitments and your current ability to afford any new loans.

You may find you have a low credit score if you have defaulted on past repayments or have a CCJ, which could be perceived as having a bad credit score.

Learn more about what credit score is needed for car finance as well as finding out how to repair credit before applying.

How to access your credit report

Your credit report will include varying degrees of detail depending on the level of access that you pay for.

You can get your credit score from any of the three credit reference agencies when you join a monthly monitoring service via a free trial.

Statutory credit report

A statutory credit report is a one-off snapshot of your credit report and credit history. It contains financial information about you, and lenders will use it to make a decision whenever you apply for credit.

We have plenty of informative resources on credit – from understanding your credit score and the role it plays in car finance to learning how to improve your credit score. Read our credit resources here.

For more information about getting car finance if you have experienced bad credit in the past, check out our resources section, where we have information dedicated to these topics.