Featured Article

How to repair credit

Updated on July 15th 2025 by Gemma Simpson

You don’t have to put up with the dark cloud of bad credit hanging over you as you make your way through life... Read How to repair credit »

You don’t have to put up with the dark cloud of bad credit hanging over you as you make your way through life... Read How to repair credit »

Credit plays an important role in car finance eligibility. To get you on the road, we’re here to help explain more about the role that credit can play and what you can be doing to improve your financial reputation.

Explore our guides on credit scores, building up your credit file and what it means for your financing eligibility if you have poor credit.

Boosting a low credit score rarely happens overnight. Quick wins—such as registering to vote—might lift your score a little, but lasting progress comes... Read How long does it take to improve my credit score? »

There are two types of bad credit: one is defaults showing on your credit report from missed payments, due to the impact of... Read What type of bad credit do you have? »

Welcome to our infographic guide on understanding credit. In this guide, we will help explain the basics about credit – what it is,... Read What is Credit? Infographic »

Financial exclusion is a way to describe someone who has either the inability to access credit or is having difficulty accessing mainstream financial... Read Bad Credit and Financial Exclusion »

There is no definitive minimum credit score requirement to get approved for car finance when buying a car. However, the relationship between credit... Read What credit score is needed for car finance? »

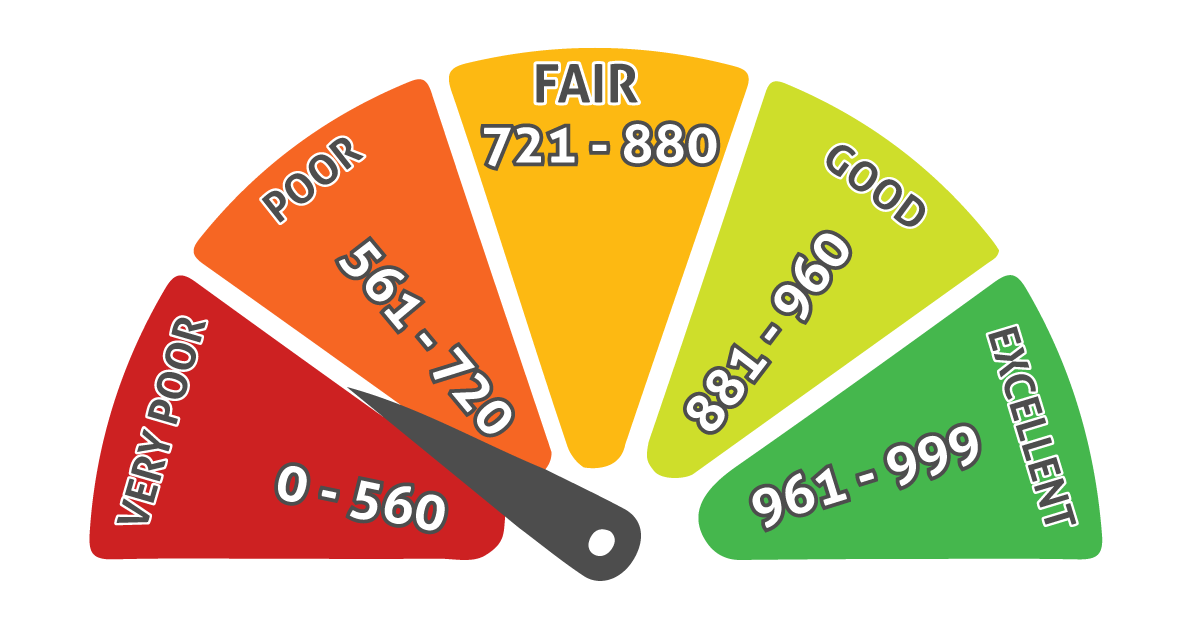

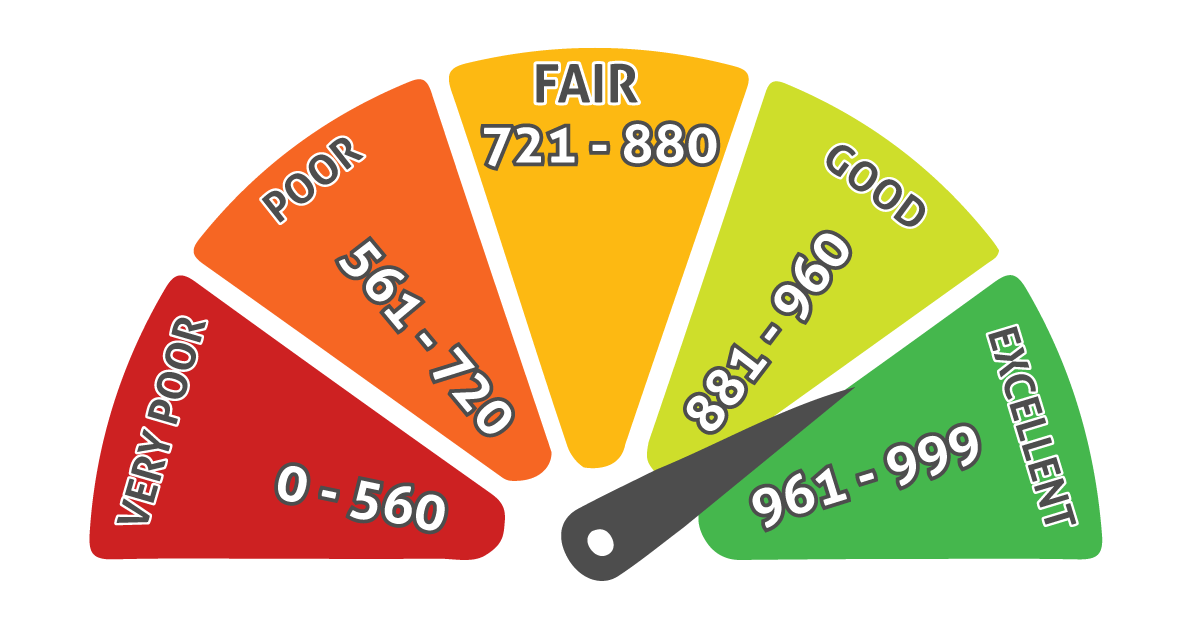

In the financial landscape of the United Kingdom, a credit score is a key indicator of your financial health. It’s a numeric representation... Read What is a Bad Credit score? »

A good credit score can change depending on the credit reference agency used. Experian, Equifax, and TransUnion are the most used credit reference... Read What is a Good Credit Score? »

When you apply for a car loan, the lender will look at your credit history to determine whether to risk giving you credit.... Read How do lenders use my credit information? »

Arranging car finance is about more than finding a payment you can afford each month. You also need to know that the company... Read How the FCA Protects You When You Take Out Car Finance »

Working towards life’s big purchases can be a bit of a struggle when you’ve got a poor credit history. When it comes to... Read A guide to securing car loans with poor credit »

Credit myths are common. This is even more true when you are looking at car finance with... Read Credit myths and the truth behind them »

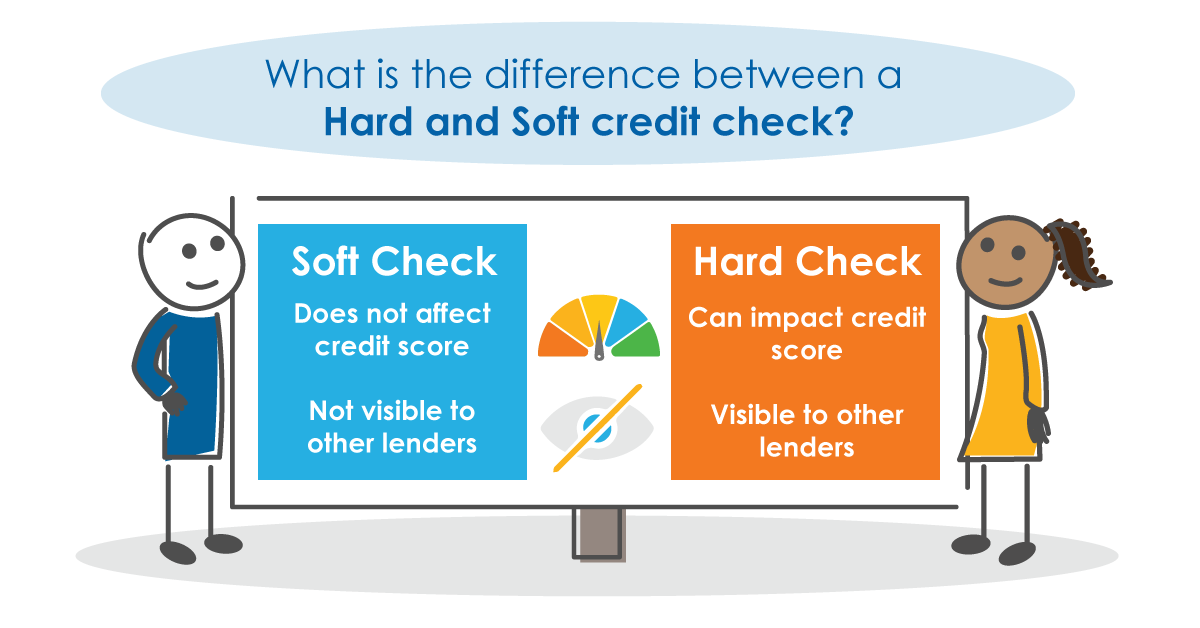

Navigating the financial landscape often involves understanding a range of terminologies and procedures, two of the most common being hard and soft credit... Read What is the difference between a Hard and Soft credit check? »

If you’ve ever missed a payment or had a default, you might wonder how long bad credit stays on your file. Knowing this... Read How Long Does Bad Credit Stay on Your File? »

A credit score is only a number. It does not define who you are. This page explains why that number might feel personal,... Read Why Your Bad Credit Score Doesn’t Define You »

Thinking about car finance? It may help to check your credit profile first. This shows how you’ve managed borrowing in the past. It... Read Review your Credit Profile »

Have you ever wondered how credit started in the UK and how different it is today compared to the past?, we have put... Read The history of credit in the UK infographic »

Rates from 24% APR, 34.5% Representative APR - Subject to status and affordability.