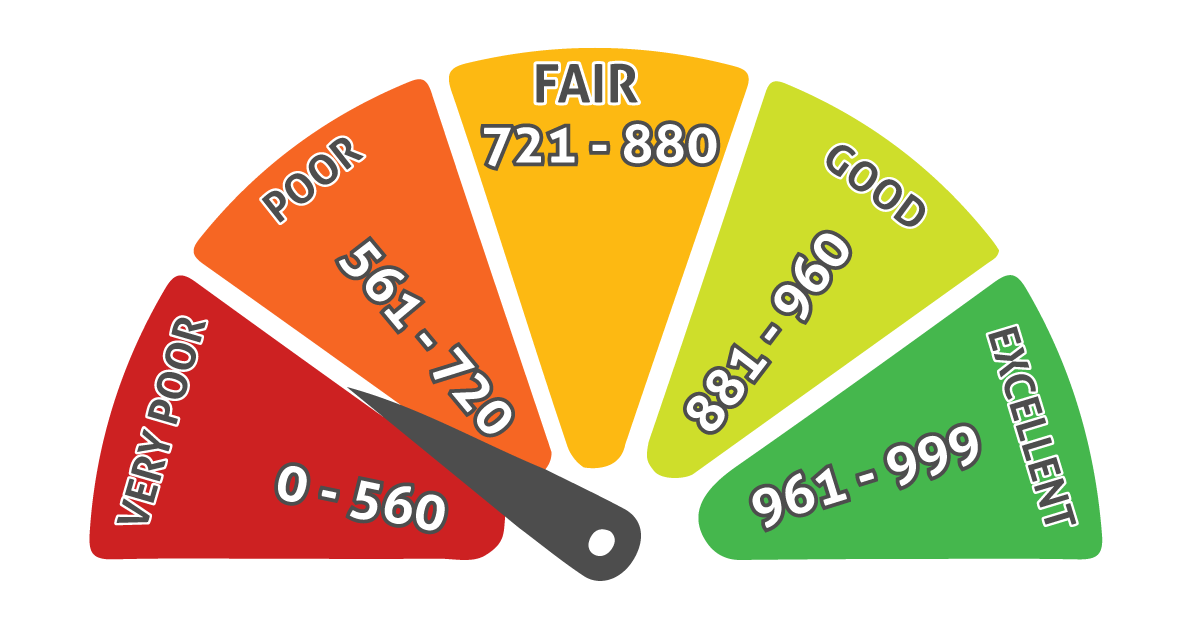

You will hear the term ‘credit score’ when you are looking to apply for car finance, a mortgage, personal loan and credit cards. But what does it really mean, and what does a bad credit score look like? A credit score is a three-digit number calculated from your credit report and is one factor used by lenders to determine your creditworthiness for car finance, a mortgage, loan or credit card. Your score can affect whether you are approved, as well as what interest rate you are charged.

Lenders will take a look at your credit information, which gives details of your financial history. They will then be able to find out whether you have a mortgage, how much you owe on credit cards and whether you have missed any payments.

Your credit score will affect more than you think. Take a look at the below list of what your credit score will affect:

1. Mortgages

2. Credit Cards

3. Loans

4. Utility Bills

5. Mobile Phones

6. Car and Home Insurance

7. Bank Accounts

It is essential that the details held on your credit file are accurate. You should check your credit file once a year by requesting a copy from all three credit reference agencies – TransUnion, Equifax and Experian – as there are likely to be three slightly different versions of your credit report.

The Consumer Credit Act gives you the right to obtain your full statutory credit report at any time at a cost of £2 per report.

If you spot a mistake on your file, you should contact the relevant agency and ask for a correction, explaining why it is wrong and supply any appropriate evidence.

Bad credit doesn’t have to follow you around forever. Redundancy, bad luck, or simply the mismanagement of credit can put you in a situation where you have bad credit. However, bad credit does not have to follow you around for the rest of your life.

Information does not stay on your credit report forever. A missed payment on your credit card will usually be wiped off after three years. Details of a County Court Judgment or bankruptcy should remain on your file for six years.

Here at Go Car Credit, we are specialists in bad credit car finance. We understand that everybody’s credit rating and circumstances are different. We want to help you find a car that suits your needs and is affordable, even if you have had bad credit in the past. Not only that, but we also understand that with previous bad credit, obtaining a car loan can be a daunting task, so we are here to help.