If you are thinking about changing your car you may have heard the term ‘negative equity.’ In this article, we help explain what this means and how it could impact your next car purchase.

What does negative equity mean?

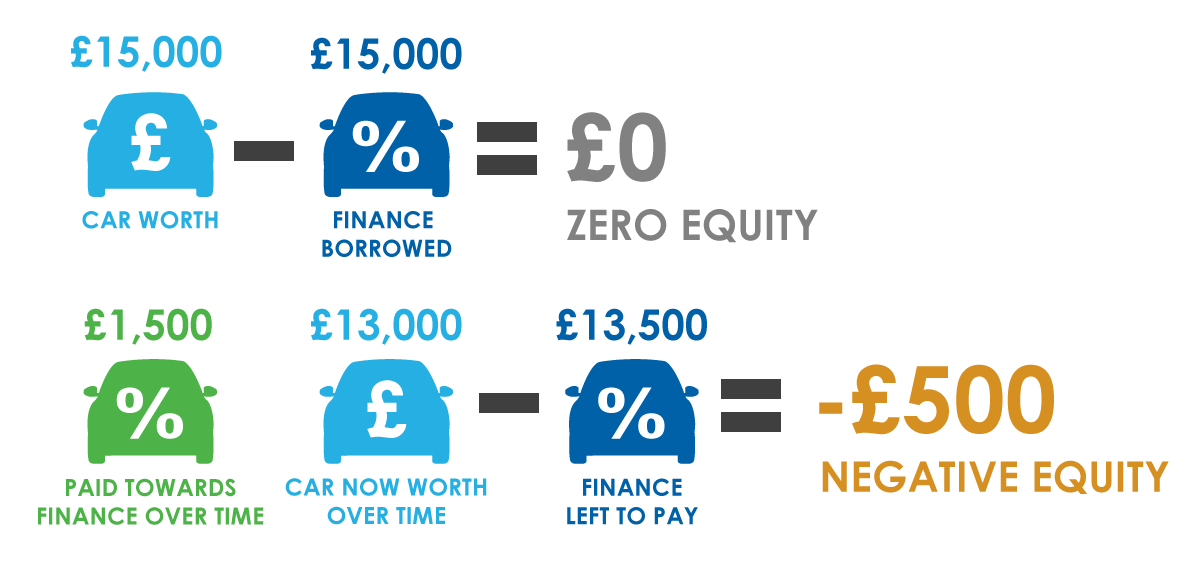

A car that is in negative equity means it is worth less than the outstanding finance against it. This is normally caused by the value of the vehicle depreciation.

For example, if you bought a car for £15,000, with finance for £15,000 and the vehicle is now worth £13,000, and you have only paid off £1,500 you would be in negative equity as there would be £500 difference between the value of the car and the outstanding finance.

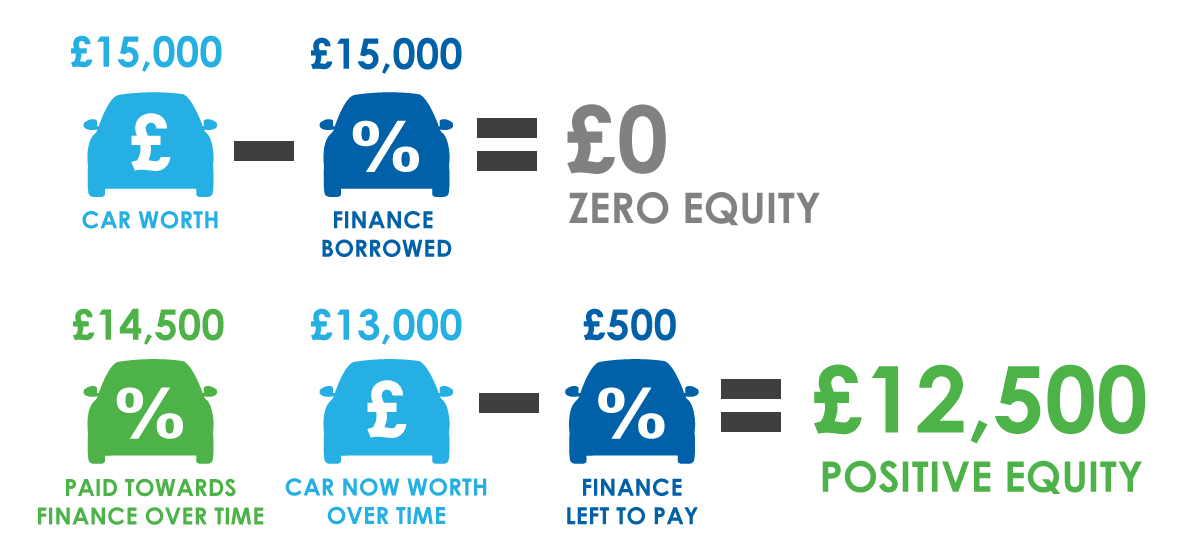

However, if you had bought a car for £15,000 with initial finance for £15,000 and the car is now valued at 13,000 but you have paid off £14,500 you would not be in negative equity as you are near the end of your agreement and have very little finance outstanding.

Negative equity can sometimes be referred to as upside down, wrong way up or back to front.

Why does negative equity occur?

Negative equity can commonly occur if you are looking to exit a car finance agreement earlier than expected.

Most cars will depreciate in value and are likely to depreciate faster at the start of a financial agreement, especially on newer (or nearly new cars). You are less likely to be in negative equity later in your financial agreement as the repayments and covering the depreciation.

Once you reach the end of the agreement there would be no remaining finance balance so no negative equity. The longer you stay in your agreement the less likely it is to have negative equity.

Negative equity and PCP car finance

Negative equity can be more likely to occur depending on the type of car finance that you have.

If you are paying for your car through a PCP deal, then negative equity can be more common. This is because you are often paying smaller, monthly payments leaving a balloon payment at the end of your agreement. The amount you owe exceeds the value of the car.

Negative equity and Hire Purchase car finance

If you’ve opted for a hire purchase car finance agreement, which does not have a balloon payment, then you are opting to pay for the entire car (and own it at the end of your agreement). This means you are paying off the value of the car much quicker than PCP and are therefore less likely for the car to be in negative equity should you wish to exit your agreement.

How do I know if my car finance is in negative equity?

You will need to get a settlement from your current car finance provider.

You should get an estimate of your vehicle’s current value too. This can be done by visiting your local used car dealership or there are tools online that can provide estimates. These include:

You should be truthful about the mileage and condition of your car so you can get the most accurate valuation.

If we are your current provider, then you can login to your My Go Car account and get a settlement figure.

What should I do if I have negative equity?

To clear the negative equity, you should either:

- 1) Put savings towards the difference or

- 2) Stay in your current finance agreement and continue to make more payments until the outstanding balance falls below the vehicle’s value.

How do I get car finance when I have negative equity?

Here at Go Car Credit, we are unable to take any negative equity and add it on to a new finance agreement. It is unlikely other car finance providers would do this either.

If there is negative equity, then you will either need to make up the difference yourself to clear the finance or continue to make more payments on your finance agreement until you are no longer in negative equity.

Want to apply for car finance?

Our car finance specialists are always on hand to explain how we could help you with your next car purchase. If you are an existing customer looking to upgrade or a new customer to Go Car Credit speak to us today to understand your options.